The Social Bank Problem

In tough economic times getting investment for a start-up can be difficult. Banks are risk-averse, despite the rhetoric of wanting to help businesses, their processes and policies constrain them.

Banks have come under a lot of fire recently for a variety of reasons, not least of which is their inability to adapt to the modern customer. Surely it is time for banks themselves to innovate, to review their model of working.

We understand these behemoths are complex business systems. However, they also have the resources to put behind new initiatives – become a more transparent and open social bank.

The problem for start-ups:

- right expertise but often lack the business background to prepare extensive business plans and financial plans

- don’t understand how to present themselves to possible investors

- haven’t got the business model or idea refined

- unsure of how or who to get help from – banks are often the first port of call for funding but have limited advisory services

- banks do not provide in-depth help and tools (limited resources and most point to the advisor’s in the retail bank).

- Banks do not fully understand and have experience of every market sector, so they might not fully understand the opportunity, the person’s expertise and the dynamics of the market sector

The Social bank Idea

Crowdsourcing is not new (see our blog on crowdsourcing). Kickstarter and many other crowdfunding sites have demonstrated the power of connecting the right people with their interests or cause.

The Social Bank for Start-ups

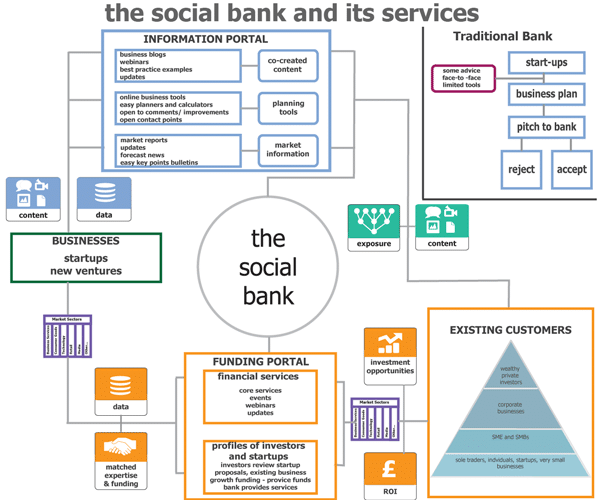

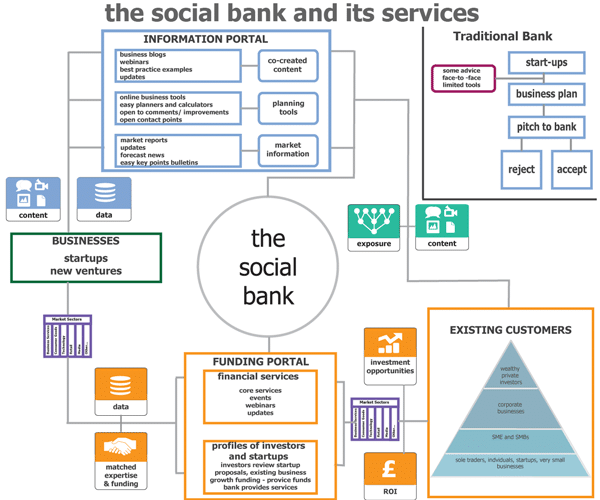

Banks have an existing portfolio of investors who may want to review and invest in start-ups; mainly if they are also fit their experience and background, e.g. match their market expertise. A permission-based portal could start-ups to initially use the information portal to develop their plan and get market research and data (note: information and funding portal are the same websites just identified differently for the sake of the diagram). They could then submit their proposals online to the funding portal and express what type of investor they are interested in (yes I can hear your say any!).

The Social Bank for Investors

The bank’s clients (investors) get the opportunity to place their money in a business that they may find interesting, relevant to their experience and may also want to put resources and help the company beyond financial backing. This model would also support micro-funding for some start-ups so that investors could part fund the start-up opportunity. Investors can also contribute content, industry expertise to the information portal, guides and help – the bank acting as editor/moderator).

The Bank – The Benefits

The bank reduces its risk (and they like that!) so that investors are assessing and placing their money at their own risk (the bank mitigates this by the process of helping the start-up with the advice and tools). The bank benefits by increasing the number of start-ups that it attracts, the exposure it gets from successes and the transactions and financial services it provides.

The Benefits of A Social Bank

The benefits are:

- Start-ups get access to funds

- Investors get a regular portfolio of opportunities to invest in

- Opportunities can be matched to the local/national or international level

- Content benefits everyone and delivers best practice tools – reducing the time for start-ups to get their plans together

- Success stories can form a stream of ongoing PR for banks

- Matching of industry expertise and secondary support helps the success rate of the start-ups